-

11-01-2014, 09:32 AM

#176

Re: Elevation; Investment Intelligence Corporation; dba Prophetmax Managed fx; Senen Pousa, Joel Friant, Michael Dillar

Originally Posted by

marsh56

Your minds are already made up.

Yep, and you've only reinforced the fact we were right all along, both about you and Dillard.

The only thing necessary for the triumph of evil is for good men to do nothing

-

Post Thanks / Like - 0 Thanks, 1 Likes, 0 LMAO, 0 Dislikes, 0 Ignorant, 0 Moron

1 Member(s) liked this post

-

11-01-2014, 04:06 PM

#177

Re: Elevation; Investment Intelligence Corporation; dba Prophetmax Managed fx; Senen Pousa, Joel Friant, Michael Dillar

Originally Posted by

marsh56

Too many holes in these arguments, too little time and NO time to waste here.

In other words you CLAIM there are holes in the arguments made and that they are full of errors but you are totally unable to point out even ONE of the large number of errors you claim to exist!

Not alone that you still have not provided ANY evidence Dillard ar elevation are legit and sensible investments.

Now maybe you can tell me what the difference is between

A - No evidence from you of the of unicorns you promised exist

and

B - No unicorns?

Glad you guys are having a good time. Again, you are all always right so there's no need for any further debate. Your minds are already made up.

You have not provided ANY debate! No actual evidence of your unicorn elevation investment was supplied.

1. I would never post my personal policy here since God only knows where it would end up, edited etc. My clients get to see my policies and my other "alternative" investments. You do not. Nothing to hide. I sleep well at night.

You cant claim you have nothing to hide and then also claim you want to keep your evidence secret! Maybe your proof is with the unicorns?

There are bad apples in every single industry on the planet. You will find just as many licensed financial planners who rip off people as licensed insurance agents.

You still have not supplied evidence to support the claim you are licenced. Im quite happy that you dont have to post it in public but you can validate it with a local lawyer or just send it to one of the admins who will not make it public and validate it. Or your local free legal aid lawyer or priest Im happy to accept that they look at your licence or policy and post here saying they saw it and it makes sense. A local Chairman of the Chamber of Commerce might also do something like that. Im sure we can arrive at a way to validate but I dont believe you will provide the evidence because I dont believe it exists.

But let me be clear YOUR CLAIM = Burned of evidence is on YOU to provide. We don't have to provide anything.

In all cases, it is WRONG and the wrongdoers should be held accountable. Painting the sales people with a broad brush does not disprove the value of the concepts and their proper implementation and use.

We do NOT have to disprove YOU made the claim! YOU have to support it!

Regardless of what any of you think of me, I help clients every day and feel really good about what I do. Not only do I sell so-called "safe money" plans but I also OWN them. And my wife and I are doing very well, thank you. WE have not been ripped off by our advisors and I do not rip off clients. Believe it or not. I could care less what you all think or speculate.

So you say but YOU have utterly failed to support any of these claims. Whether or not we believe you is beside the point. whether you can support your own claims is the point!

One final note: I do not see any reference here to Dillard's LFP program. It is a mentoring program that costs $37 per month and teaches you from beginning to end how to come up with a product, market it and monetize it, all online. All weekly lessons are recorded and you can cancel at any time.

Now you are on to ANOTHER programme! Do we have to start a thread on that and have no evidence from you there too?

Of course, I am sure you guys will find ways to poke holes in it and call it yet another scam. Have fun.

Of course if YOU CLAIM IT it is for YOU to provide supporting evidence. WE dont have to do anything.

-

Post Thanks / Like - 0 Thanks, 1 Likes, 0 LMAO, 0 Dislikes, 0 Ignorant, 0 Moron

1 Member(s) liked this post

-

11-03-2014, 10:51 AM

#178

Re: Elevation; Investment Intelligence Corporation; dba Prophetmax Managed fx; Senen Pousa, Joel Friant, Michael Dillar

Originally Posted by

marsh56

Too many holes in these arguments, too little time and NO time to waste here.

Glad you guys are having a good time. Again, you are all always right so there's no need for any further debate. Your minds are already made up.

There has been no debate on your part Mark, just canned sales talk and unsubstantiated math backed with more feel good. Yes my mind is made up both Dillard and Gunderson were unable to detect massive Ponzi schemes, they have no business being near anyone's money. Further Gunderson has been kicked off most networks for being a flake, even organizations that exist to sell advertising would rather not subject their viewers to his nonsense.

Originally Posted by

marsh56

Just a couple of final comments @ ribshaw since he does the most jaw jacking here.

If by "jaw jacking" you refer to my warning people about your questionable math using life insurance as a piggy bank, then yeppers. I will echo what Robert Castiligone said to you on the other thread "I don't think you understand what you are selling".

All your back peddling here and there confirms it, and I highly doubt your "clients" know what they are in for.

Originally Posted by

marsh56

1. I would never post my personal policy here since God only knows where it would end up, edited etc. My clients get to see my policies and my other "alternative" investments. You do not. Nothing to hide. I sleep well at night.

I did not expect you to post your personal details. How about Joe Sample 54 year old male funding a policy for 10 years . Show us how much he can withdraw" tax free" via policy loans without lapsing the policy or putting any more money in by age 121.

This is where you are creating a time bomb for your "clients", they will either be able to safely withdraw a lot less than they are lead to believe or their polices will lapse.

Gunderson et. al. with their 401K/IRA bashing should be held to the same standard.

Originally Posted by

marsh56

2. To your point about surrender charges: most every policy has them. These plans are designed as LONG term plans, usually 10-15 years or more. There is no reason to surrender them and all of this is explained up front to the client. In our practice, we always use a proper needs analysis and do at least annual reviews or as necessary if a client's situation changes.

Everyone has seen how you describe things, they can square that with the reality you have to keep being brought back to. A lot of good "break even" does at five years if the "client" loses 50-100% of their money if they chose to surrender the policy. You after all are telling people this is like their own banking system, and encouraging them to use their money.

Here is a good example, although Mark will claim this is not one of his special polices.

In Bill's case, his willingness to pay the high $35,000 annual premiums quickly faded because he was never truly committed to the purchase. So, his attorney had him order an in-force illustration for the policy that showed an account value of $55,000, but a surrender value of $0. How could there be a zero surrender value after Bill payed premiums of $105,000?

This is a detail John failed to mention, let alone emphasize.

LEAP - Is it a scam? - IRAs, 401(k), mortgage, life insurance, cash flow

Some good reading on insurance funding, I'm sure Mark meant to provide links and it just slipped his mind.

Articles Published by Katt & Company

Originally Posted by

marsh56

One final note: I do not see any reference here to Dillard's LFP program. It is a mentoring program that costs $37 per month and teaches you from beginning to end how to come up with a product, market it and monetize it, all online. All weekly lessons are recorded and you can cancel at any time.

Dillard will be peddling overpriced training for the rest of his life, I hardly consider $37 a month for the same training 1000s of others are likely getting worthwhile for most. Still nowhere near the same as destroying people's net worth by getting them involved in questionable gimmicks, high fee products, or outright scams.

-

11-03-2014, 11:44 AM

#179

Re: Elevation; Investment Intelligence Corporation; dba Prophetmax Managed fx; Senen Pousa, Joel Friant, Michael Dillar

Originally Posted by

marsh56

There are bad apples in every single industry on the planet. You will find just as many licensed financial planners who rip off people as licensed insurance agents. In all cases, it is WRONG and the wrongdoers should be held accountable. Painting the sales people with a broad brush does not disprove the value of the concepts and their proper implementation and use.Mark

Mark, I see once again your Strawman is wearing a heavy dash of Red Herring Aftershave. I never painted salespeople with a broad brush or claimed everyone who charges a fee is competent or honest. This comment is beyond stupid, but we have come to expect that from you.

If someone were buying a house without hesitation I would encourage them to get a full home inspection including mold, water, and radon. If a realtor showed up and started spouting nonsense like you posted no one would take them seriously as a professional.

In fact in every link I posted with respect to the "concept" you are selling there are insurance agents who share my concerns. Keen readers might also notice that other agents selling IBC or similar show up and pretend to be customers. One might ask why? Other agents claim how great it all is, but as in your case always fail to provide the hard numbers.

We have already addressed holding the "wrongdoers" accountable. A lot of good that does someone 30 years from now when their policy lapses and they are stuck with a massive tax bill. Measure twice cut once.

Originally Posted by

marsh56

In our practice, we always use a proper needs analysis

Mark

HERE IS WHAT MARK SAYS Infinite Banking Strategy Using Whole Life Insurance - Scam or Wise Savings Strategy?

As a supporter of the IBC, I would say the following situations are where a plan might not work.

1. An individual or family who has no assets.

2. An individual or family who finds they are constantly in debt with no assets and no plan to pay off the debt.

3. An individual or family who lacks the fiscal discipline either to finance a plan or to use it properly.

4. Anyone who does not understand either the concept or how the plans work.

Let's see what Mark recommends for someone who looks to fail 1-3, and probably 4.

one of my clients who is underwater on his mortgage and has no equity to refinance. He also has no other liquid assets other than a small emergency fund of about $5k. By the way, this is a VERY common scenario is this neck of the woods. Infinite Banking Strategy Using Whole Life Insurance - Scam or Wise Savings Strategy?

The good news is the client does have a PROPERLY STRUCTURED safe money plan. The plan was over funded with $25k that was sitting in a bank CD, languishing at 1%, thereby losing money by not keeping up with inflation. In addition, the funds were counting AGAINST the client in the financial aid formulas, increasing the family’s Expected Family Contribution (EFC).

The client also contributes a monthly amount to pay the base premium and a term rider. The remainder goes to purchase paid up additions.

================================================== ==

I don't think we need to say any more, on the importance of dealing with professionals that can do math. Never with people who will take your last $25,000 "languishing at 1%", subject it to a few grand in commissions, years of "NEGATIVE ROI", years of surrender fees, and best case make you borrow it back on the pretense that they are turning your upside down mortgage into a plan for your kid's college.

Last edited by ribshaw; 11-03-2014 at 12:04 PM.

-

05-25-2015, 02:38 PM

#180

Re: Elevation; Investment Intelligence Corporation; dba Prophetmax Managed fx; Senen Pousa, Joel Friant, Michael Dillar

-

Post Thanks / Like - 0 Thanks, 1 Likes, 0 LMAO, 0 Dislikes, 0 Ignorant, 0 Moron

1 Member(s) liked this post

-

08-21-2016, 12:27 PM

#181

Re: Elevation; Investment Intelligence Corporation; dba Prophetmax Managed fx; Senen Pousa, Joel Friant, Michael Dillar

.

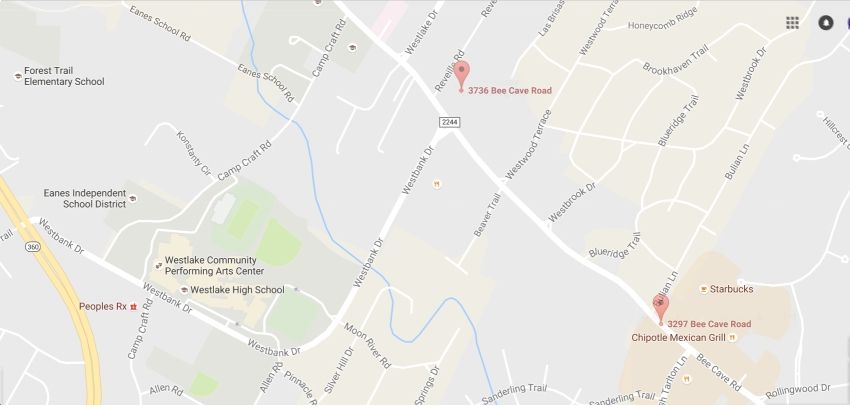

Does anyone have any insight into all of these leadership/ownership/address changes at TheElevationGroup.com?

December 2010 - I receive hundreds and hundreds of email pitches from Mike Dillard after getting on the mailing list. The address listed for TheElevationGroup is:

300 W 6th St #2200, Austin, TX 78701

which is a substantial 22-story office building. Suite #2200 today is occupied by six businesses.

October 2011 - There are PR announcements that Robert Hirsch has taken over as CEO, but the flood of EVG sales pitch emails continue to come from Mike Dillard.

March 21, 2012 - The address listed for TheElevationGroup changes to:

815-A Brazos Street, Suite 111, Austin, TX 78701

Which is a mail-drop at TheUpsStore

May 9, 2013 - The address listed for TheElevationGroup changes to:

3267 Bee Cave Rd STE 107 - PMB 104, Austin TX 78746

... another mail-drop at another TheUpsStore

January 7, 2015 - I receive my first email from Robert Hirsch in which he drones on about his "last few years as CEO of The Elevation Group".

October 1, 2015 - I stopped receiving emails from Mike Dillard and all of the EVG emails came from Robert Hirsch.

October 1, 2015 - thru January 12, 2016 I receive 19 EVG sales-pitch emails from Robert Hirsch.

January 16, 2016 - Robert Hirsch's emails switch from promoting TheElevationGroup.com to promoting raincatcher.com. raincatcher.com's address is:

625 E Main St 102B box 200 Aspen, Colorado 81611

... another mail-drop at another TheUpsStore

January 13, 2016 - A seven-month lull begins during which no one is sending me emails promoting TheElevationGroup

January 16, 2016 thru May 30, 2016 - I receive 30 emails promoting raincatcher.com from Robert HIrsch.

May 21, 2016 thru August 17, 2016 - I uncharacteristically receive only one email from Robert Hirsch, promoting raincatcher.com

August 5, 2016 - I begin receiving emails (seven total so far) alternatively from "Brian Fouts" and "Jake Fouts", and the disclaimer at the bottom of TheElevationGroup.com "products page" states:

"EVG makes no guarantee or other promise as to any results that may be obtained from using the information provided. The results achieved by Brian Fouts or Jake Fouts or EVG customers are not typical of the experience of others. You should not expect to do as well"

No mention of Robert Hirsch or Mike Dillard.

Jake Fouts and Brian Fouts both use the same mail-box at:

1323 Ave D #2290, Snohomish WA 98291

which is a United States Post Office

... but the address for TheElevationGroup at the bottom of the TheElevationGroup.com "products page" remains almost exactly at the same address they switched to May 9, 2013 ... someone just flipped the "6" to a "9" for the address of The West Woods Shopping Center where TheUpsStore at 107 is located:

3297 Bee Cave Rd STE 107 - PMB 104, Austin TX 78746

... with the "support page" sharing the same address as Jake Fouts and Brian Fouts:

1323 Ave D #2290, Snohomish WA 98291

I just find myself wondering stupid sh*t like:

► If any of these guys are the high-rolling know-it-alls of finance that they present themselves to be, how come they ditched the only office that appears to be real that they have ever rented after one year of occupancy in 2011?

► If The Elevation Group is such a sh*t-hot business, why does it appear to change ownership so frequently?

► If The Elevation Group is such a sh*t-hot business, why did all email promotions cease from January 13, 2016 thru August 5, 2016?

► Who the hell are Brian Fouts and Jake Fouts and just what un-discoverable experience have they ever had dispensing financial advice and products that makes what they are trying to sell today worth $97 per month ("for access to the investment secrets of the wealthy")?

► If Mike Dillard hasn't been associated with The Elevation Group since October 2015, how come all of the testimonials on the EVG website enthusiastically thank Mike?

Mike Dillard appears to be selling his priceless financial advice solo at MikeDillard.com, claiming "420,000 subscribers" with a contact address at:

3736 Bee Cave Road, #1-162, Westlake Hills, Texas 78746

...which is box #162 at "West Lake Mail" ... a mail drop.

SD

.

"No one in this world, so far as I know - and I have researched the records for years, and employed agents to help me - has ever lost money by underestimating the intelligence of the great masses of the plain people" - H. L. Mencken

-

Post Thanks / Like - 0 Thanks, 1 Likes, 0 LMAO, 0 Dislikes, 0 Ignorant, 0 Moron

1 Member(s) liked this post

Originally Posted by marsh56

Thanks: 0

Thanks: 0

LMAO: 0

LMAO: 0

Dislikes: 0

Dislikes: 0

Ignorant: 0

Ignorant: 0

Moron: 0

Moron: 0

Originally Posted by marsh56

1 Member(s) liked this post

1 Member(s) liked this post

1 Member(s) liked this post

1 Member(s) liked this post

1 Member(s) liked this post

1 Member(s) liked this post

1 Member(s) liked this post

1 Member(s) liked this post

Bookmarks